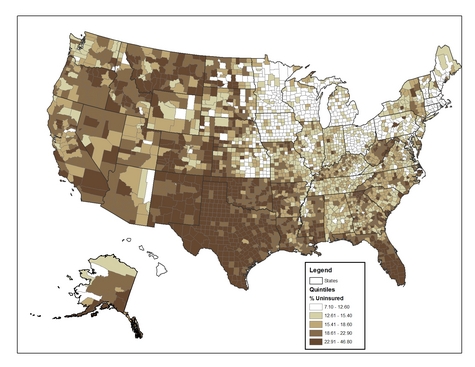

Andrew Sullivan at the Daily Dish linked today to this post at The Monkey Cage mapping out the level of health insurance among Americans.

I thought it was striking how dramatically different some states were — like Nebraska and Iowa, for example — almost precisely along their borders.

Meanwhile, Ben Nelson continues to make his relatively uninsured Nebraskans proud by coming out against plans to offer a public health insurance option because it could hurt the insurance industry. For what it’s worth, Healthcareforamericanow.com has pointed out that insurance companies make up Nelson’s largest donor group.

From Matthew Yglesias at Thinkprogress:

Health care reform is an enormous, complicated undertaking. Nobody’s going to be thrilled with every provision of a bill. So it’s important to know where one’s deal-breakers lie. Nelson says his deal-breaker is that health reform needs to protect the interests of insurance companies. It’s good to know.

That’s a very interesting picture, but it does leave some questions. Why are the different categories so different in how many people they represent. Group one represents a 5.5% gap, 2 is a 2.79% gap, 3 is a 3.19% gap, group 4 is a 4.29% gap, and group 5 is a whopping 23.89% gap. This map doesn’t really show us anything except that the majority of the country has either 22.91% of people uninsured or 46.8% are uninsured. So what is it? Are about 1/4 uninsured or 1/2? BIG difference.

Secondly, the study ignores people over 65 because they have Medicare. That isn’t really a fair assessment of the situation. My grandfather was diagnosed with lymphoma a few years back, and believe me, Medicare makes up a small fraction of the bills; his private insurance covers the rest. By not reporting people over 65 it ignores a HUGE population that needs health care reform.

Finally, Ben Nelson’s comments on Yglesias’ site say that the plan would hurt private insurance PLANS, which I agree with. The whole idea behind insurance is that many people pay in and few people take out. If we introduce a public plan where they pay in is low and the pay out is high, then it would hurt those of us who have private insurance.

Currently, I am living overseas, and I recently had the misfortune of paying some medical bills here. 3 weeks in the neurology department of a university hospital, an emergency room visit, and some staples. The total bill was about 4800 dollars. The median income in this country is about 20,000 dollars per year. There is a national health care plan here that is a joke (it gives a discount on prescriptions, and only covers illness, not accidents) and everyone is covered by private insurance as well.

My point is this – the problem is not with the insurance industry so much as it is with the medical industry. High quality care here cost a fraction of what it costs in the United States. Let’s address THAT problem instead.

If you don’t mind sharing, Nathan, where are you living?

In theory, I agree with what you’re saying about how private plans would work. But the simple fact is that if private plans were working in practice at providing broad, affordable coverage by spreading costs, this conversation wouldn’t be happening. There’s no mystery in how private plans are supposed to operate, but I fail to see the logic in prioritizing their interests and protecting them when they’ve failed to live up to those theories in practice. Given that insurance companies have essentially evolved into investment banks that are structured in a way to make it as difficult as possible for investors to get any kind of return on what they’ve put in, I think that distinguishing between plans and companies in this case is largely semantics. I don’t disagree with your point about medical costs, but it seems to presuppose that insurance companies are little more than a victim in the big picture.

Out of curiosity, how do you feel about a single-payer system?

No problem! I live in South Korea right now. Also, with my National Health insurance card, I paid a grand total of about 4 dollars for a general doctors visit and a weeks worth of drugs last week. Without the National Insurance card, it would have cost me about 9 dollars.

Anyway, I agree with you that we should not prioritize the interests of the insurance companies. I disagree with your assertion that the plans and companies have become one, making it semantics to argue the differences. A look at a Blue Cross web site shows that they have many plans to offer, with many different combinations of deductibles, premiums, levels of coverage, etc.

I don’t believe that the key to health care reform is a national system or compulsory coverage. It is cost control. A study in 2007 shows that health care costs have risen 78% since 2001, yet wages have only risen 19%. (http://www.kff.org/insurance/ehbs091107nr.cfm) Every equation has two sides, supply and demand. In this situation, why has the supply become so costly? That’s the real question.

Single payer system? I’m not a fan. It’s like Henry Ford said, “you can have any color as long as it’s black.” I like having a choice in my health plans. Right now, I’m relatively young and healthy, so a low premium, high deductible plan works for me. In a few years, if I have a family with a kid who’s as clumsy as I was, a higher premium, lower deductible would be good for me. There are just so many health care options out there and I like having choices.

Overall, I’d say the government should look at the insurance industry regulations and make sure that the insurance companies are 1) advertising their products properly, 2) providing the products/services that they claim, and 3) competing with each other. As for the costs of the health care, some serious studies need to be done. I think that this is a multi-angled problem. Rising numbers of elderly, huge influxes of immigrants (legal and illegal), terrible lifestyle choices, etc. It’s only through a multifaceted approach that this problem can be solved.